Investing in rental properties in Canada is a popular way to build wealth, generate passive income, and diversify one’s financial portfolio. However, it requires careful planning, knowledge of the market, and an understanding of the laws and regulations governing real estate. Whether you’re a first-time investor or looking to expand your portfolio, here’s a practical guide to help you get started.

1. Understand the Canadian Real Estate Market

Begin by researching different markets across Canada. Each province and city has unique conditions that affect rental demand and property values. For example, Vancouver and Toronto are known for high property prices but also offer strong rental demand, while smaller cities like Halifax or Saskatoon may provide better affordability and room for growth. Understanding local vacancy rates, rental yields, population growth, and job markets is essential before deciding where to invest.

2. Set Clear Investment Goals

Determine what you want from your investment. Are you looking for monthly cash flow, long-term appreciation, or a combination of both? Your goals will influence the type of property you buy—condo, single-family home, duplex, or multi-unit apartment—and the location you choose.

3. Secure Financing

You will likely need a mortgage to purchase your rental property. Canadian lenders typically require a minimum down payment of 20% for investment properties. Ensure your credit is strong and explore different mortgage products. Speak to a mortgage broker or financial advisor to understand your borrowing power and interest rate options. One example of a mortgage broker is Multi-Prêts Mortgages.

4. Choose the Right Property

Look for properties in desirable neighborhoods with good transit, schools, and amenities. Consider the condition of the home and any potential renovation costs. Use tools like cap rate and cash-on-cash return to evaluate whether a property is a good investment. Asking a real estate agent for advice can always help. There are plenty of agents willing to assist buyers and/or renters. The popular real estate agencies include remax.ca, Royal Lepage, and Realtris.

5. Understand Landlord Responsibilities

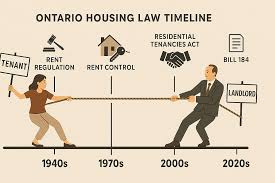

Familiarize yourself with provincial landlord-tenant laws, including rules around rent increases, security deposits, and eviction processes. Consider hiring a property manager if you prefer a hands-off approach, especially if the property is in a different city.

6. Plan for Expenses and Taxes

Be sure to budget for maintenance, property taxes, insurance, and potential vacancies. Income from rentals is taxable in Canada, but you can deduct many expenses, including mortgage interest and repairs.

Investing in rental properties can be highly rewarding, but success depends on informed decisions and long-term planning. With the right approach, real estate can offer both financial stability and future growth.

Search

Categories

Recent posts

Tags

- a louer

- affordable apartments Toronto

- affordable housing

- affordable housing solutions Canada

- Air Filters

- air quality

- apartment

- apartment close to public transport

- apartment for rent

- apartment for rent montreal

- apartment for rent Toronto

- apartment insurance

- appartement

- appliances

- ARTICLE

- available for rent

- background check

- bacteria

- best city to live in canada

- best healthcare

- bicycle

- bicycle path

- bike lane

- bike path

- bikes

- bill 16

- burglar

- buy a house

- buying a house

- carbon monoxide detector

- cars

- centris

- city

- cleaning

- cleaning products

- cleaning wood floors

- closet

- closet space

- clothing organizer

- compact rental units

- condo

- condo association laws

- condo fees

- condo for rent

- condo insurance

- construction budget

- construction contractors

- construction cost

- credit check

- decorating room

- digital transaction

- door lock

- doors

- downtown micro apartments

- electricity

- employment verification

- energy consumption

- energy cost

- energy saving

- engineered hardwood

- fire alarm

- fire detector

- fire extinguisher

- floor

- flooring

- for rent

- For rent in Montreal

- For rent in Toronto

- For rent in Vancouver

- for sale

- furniture

- gas

- healthy candles

- healthy lifestyle

- home

- house

- house for rent

- house for sale

- house garden

- house insurance

- house locks

- house plants

- immigrant

- importance of water leak detector

- indoor plants

- insurance

- intergenerational home

- intergenerational living

- interior designer

- investment

- landlord

- lease

- lease responsibility

- long term care facility

- low crime

- mattress

- micro-apartments Vancouver

- micro-units Toronto

- mls

- move to canada

- moving company

- Moving to canada

- moving truck

- multigenerational home

- multiplex

- nano-suites

- nano-suites Toronto

- new apartment

- new color

- oil

- old age home

- online house purchase

- Ontario

- paint colors

- passive income

- pet friendly apartment

- pet friendly plants

- planning for vacation

- plants

- porcelain tile

- property

- questions for apartment rental

- real estate

- real estate agent

- real estate broker

- real estate online

- real estate transaction

- realtor

- renal history

- rent

- rent an apartment

- rent control

- rent obligations

- rental

- rental board

- rental scam

- renting

- residential income

- residential lease

- residential rental

- revenue property

- safe area

- safe candle in apartment

- safe candle in house

- safe candles

- safety

- scam

- security

- sell a house

- seniors residence

- small apartments Vancouver

- smoke detector

- social media and real estate

- soy candle

- soy candles made with essential oils

- storage space

- student apartment

- student housing

- tenant

- tiny rentals Canada

- traffic

- trending color

- trending paint

- university student rental

- ventilation

- vinyl floor

- water alarm

- water damage

- water leak detector

- window frame

- window manufacturer

- windows

- wood floors